Usage

The openNPL platform offers a lot of functionality. Here we break down some of the main workflows for those just getting started with the platform. More will detailed tutorials will follow as the platform develops!

See also

For more in-depth studies on using python for credit portfolio management check-out: Open Risk Academy. For Non-performing loan data domain knowledge check out the relevant entries at the: Open Risk Manual

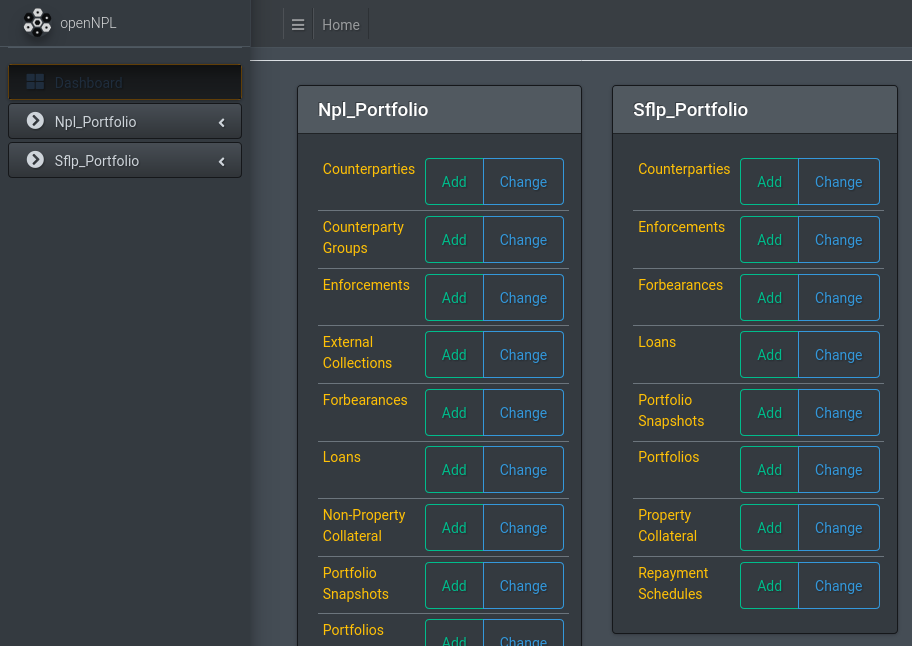

The landing page

If everything went well with the installation, upon pointing your browser to localhost:8000 (or whatever port you are using) you will meet the landing page:

Login

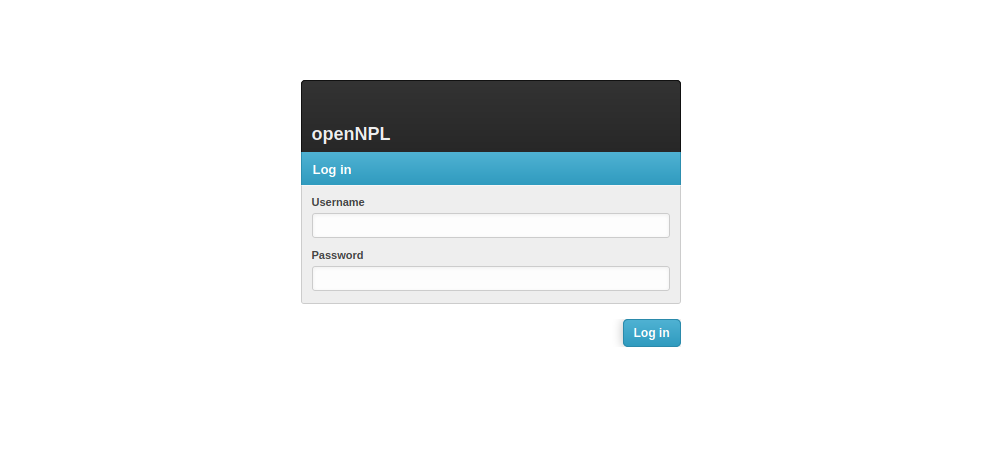

To log-in, point your browser to localhost:8000/admin (initially only an admin user is enabled). This will get you to the login page:

If you used the default demo credentials for openNPL you can login using:

Login: admin

Password: admin

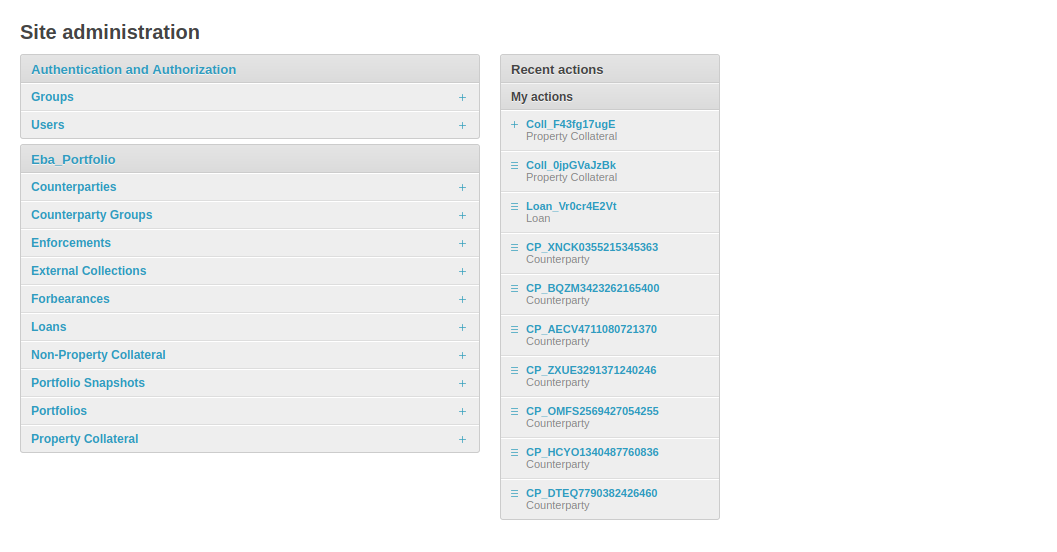

Admin Interface

After a successful login you will get to the admin interface which offers access to all the datasets:

The interface provides access to:

administrative functions like creating users and groups

a history log of activities that have been performed

user functions like inspecting and working with NPL data

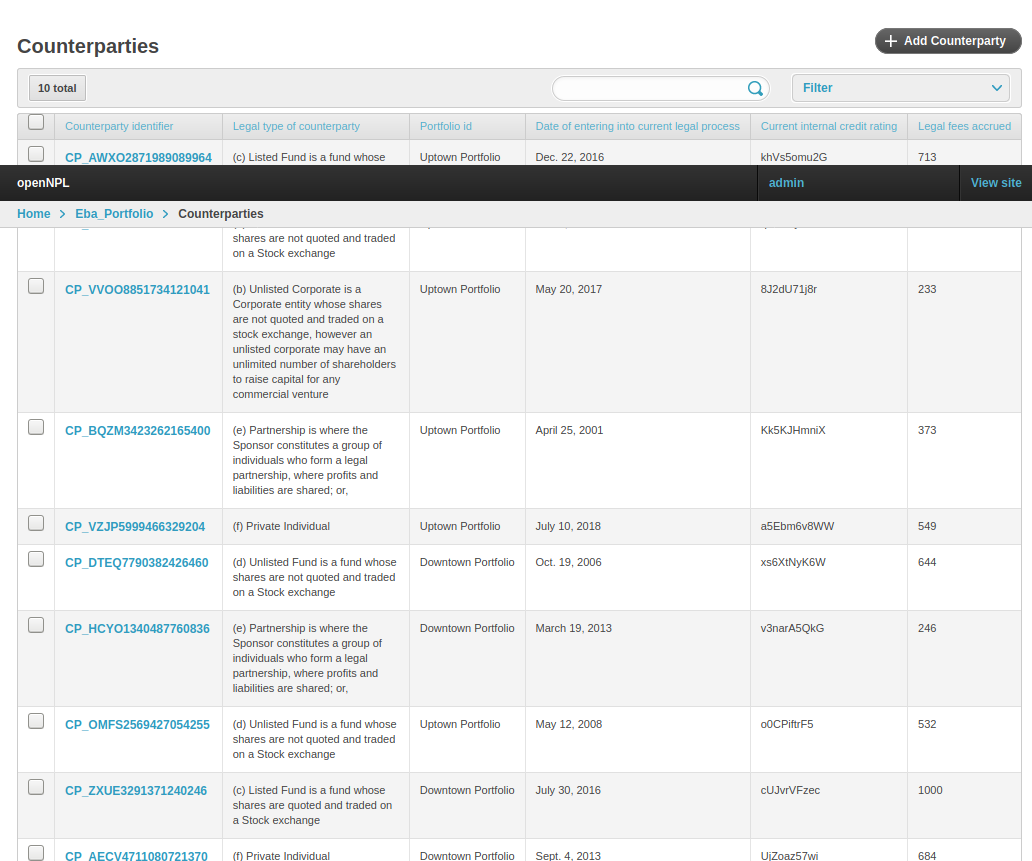

Lets click first on an important data model under the EBA portfolio collection: The Counterparty model. This gets us to a list of (randomly generated) counterparties that have been inserted into the database during the installation process:

Counterparty Data

Some key functionalities available in this view are (in summary)

viewing (sorting) counterparty data (meaning obligor or borrower data, e.g. company or individual person data)

adding new records

deleting new records

Note

this view selects only some illustrative fields out of the many recorded in the database

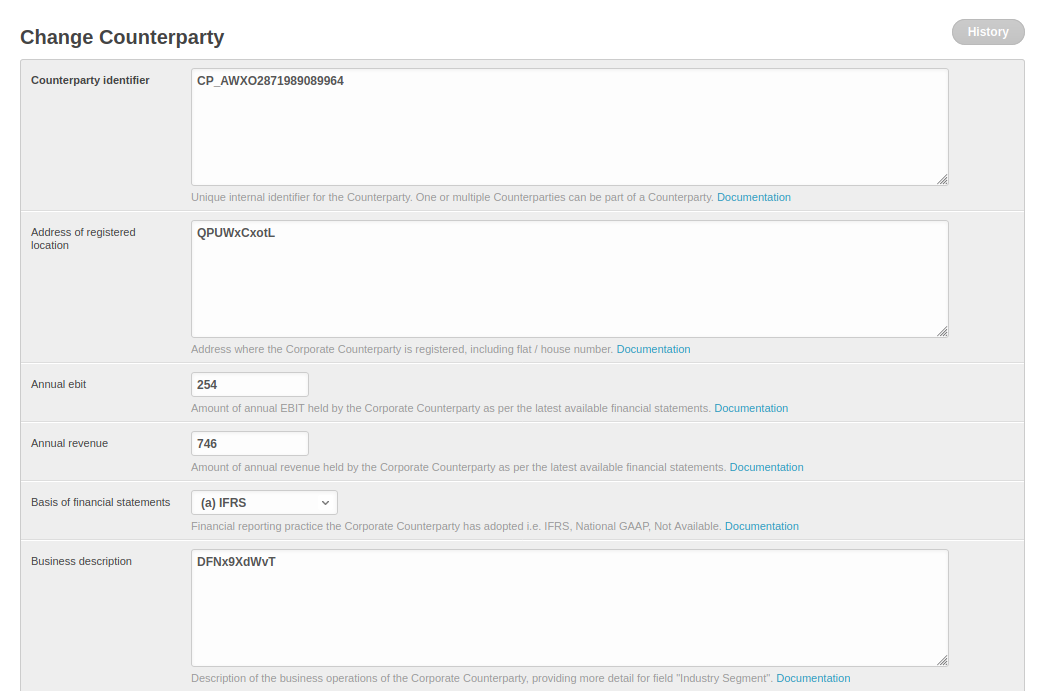

Lets click into any counterparty row to take a closer look:

All the available EBA counterparty fields are available in this view to inspect and potentially change.

Note

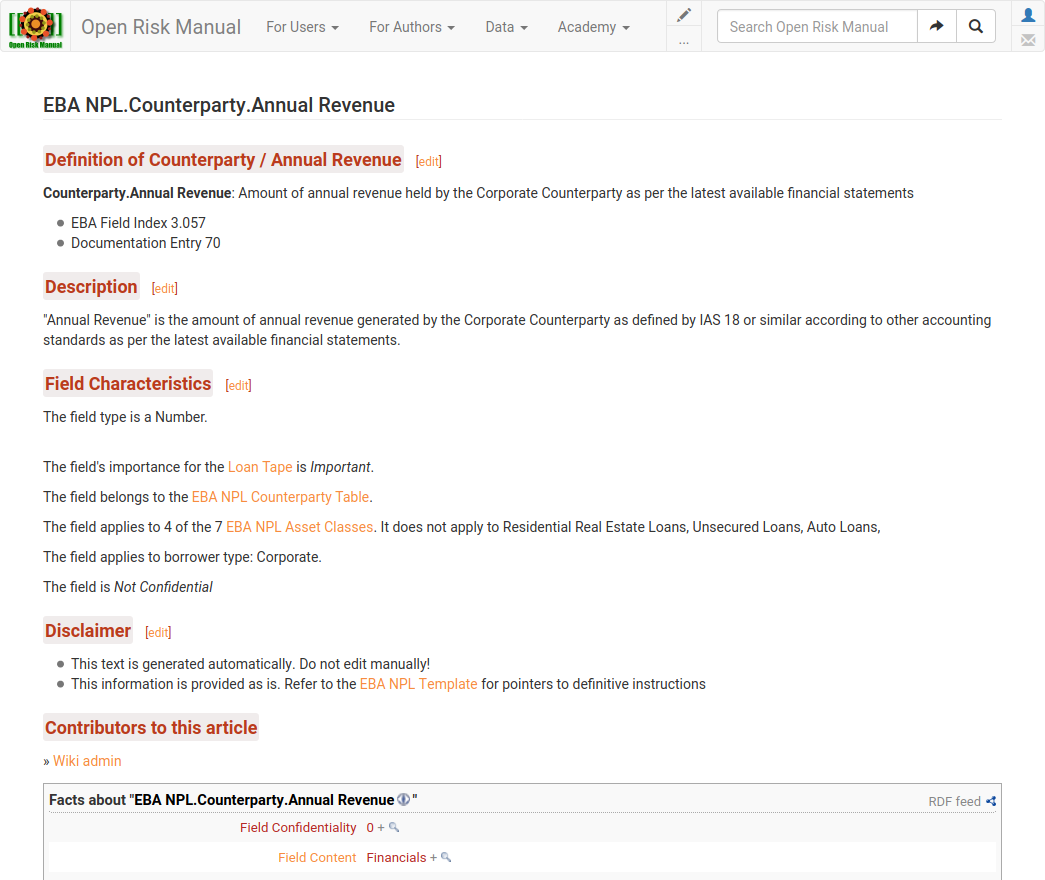

If any field is unclear, clicking on the Documentation link underneath takes you to the Open Risk Manual for the explanation. For example if we click on Annual Revenue field, we will get to the corresponding page that explains the meaning and requirements for this data point

We can go back to the overview of all data by clicking on the breadcrumb (EBA Portfolio) or pointing the browser to http://localhost:8001/admin/eba_portfolio/

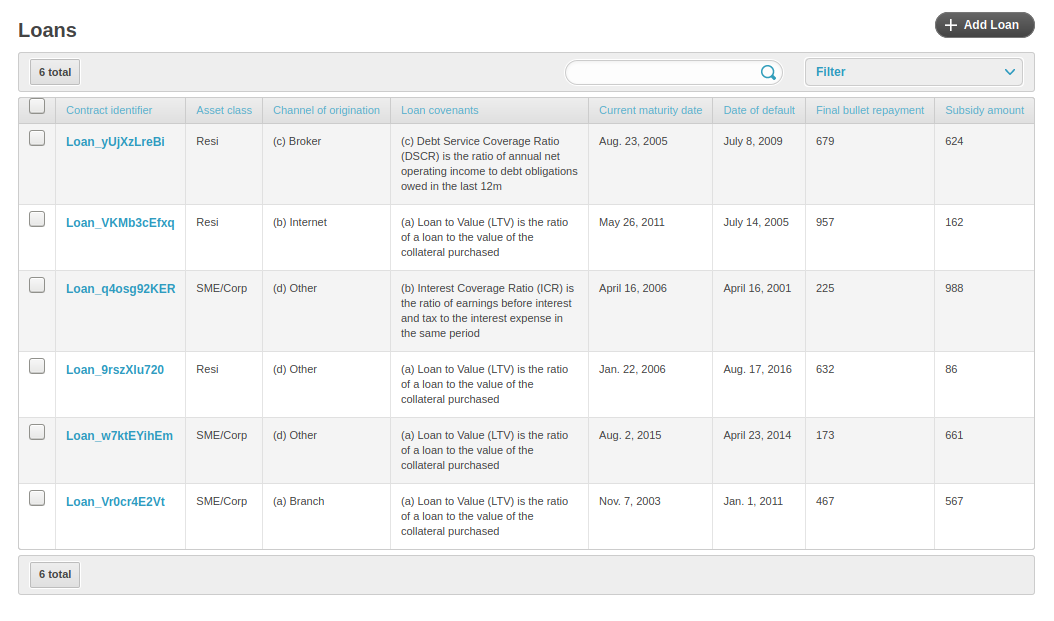

Lets take a look now at another important data model, namely the Loan model data. Loans is one of the main financial products documented in the templates (others being leases and swaps):

Loan Data

The layout is similar to what we have seen before. A selection of fields is visible in the overview and clicking through we get access to further data, e.g. which counterparty actually holds to the loan.

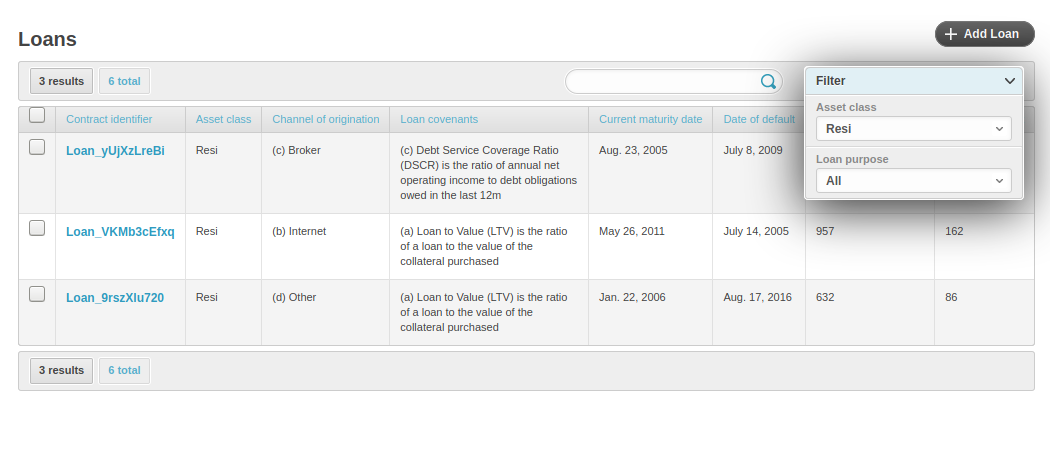

In the upper right corner we have the functionality for filtering the dataset. Clicking on the menu allows selecting the desired filter to narrow down the portfolio:

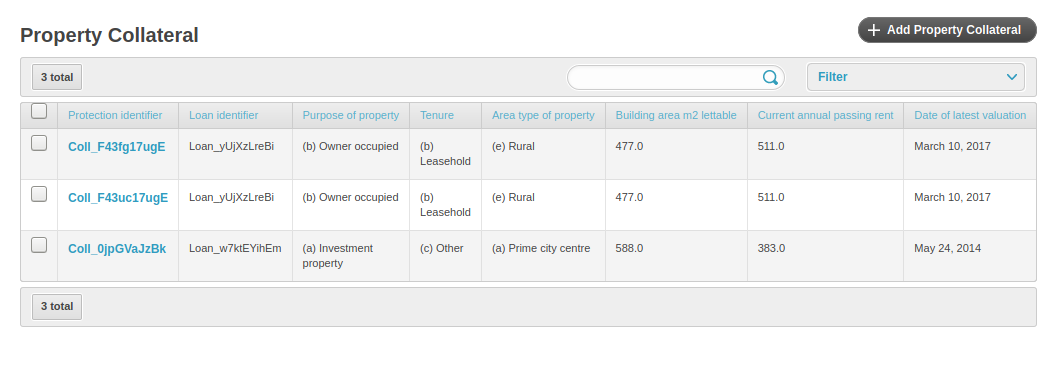

As one final example lets go back to the main list and select the Property Collateral data (in the EBA templates collateral is segmented along property and non-property classes):

Property Collateral Data

By now the familiar table display of the stored collateral data should show up:

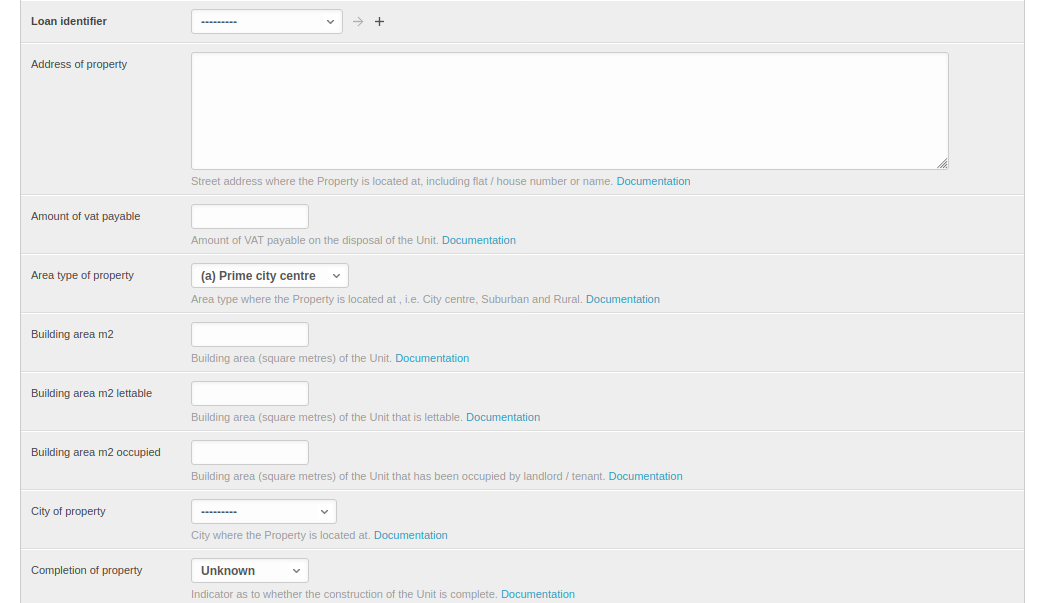

Lets try now something more adventurous! Let us try to add some data!

Click on the add data button on the upper right side of the page. You should see a form with many empty fields:

Depending on the nature of the field you can either enter text, numbers or select entries from drop-down menus. Whenever there is doubt, the documentation link is as before one click away!